A competitive analysis is a powerful tool for understanding how you compare to competitors and creating smart strategies to get noticed by consumers. Most companies are doing it on a monthly, quarterly, or annual basis.

If you feel like it’s been awhile since your company has performed a competitive analysis, not to worry — today’s technology (thanks, internet) makes it easier than ever to get started and quickly get informed. In this article, we’re going to walk you through the basics of a competitive analysis, the benefit of doing one, and 7 steps to conducting one for your company.

Quick Takeaways

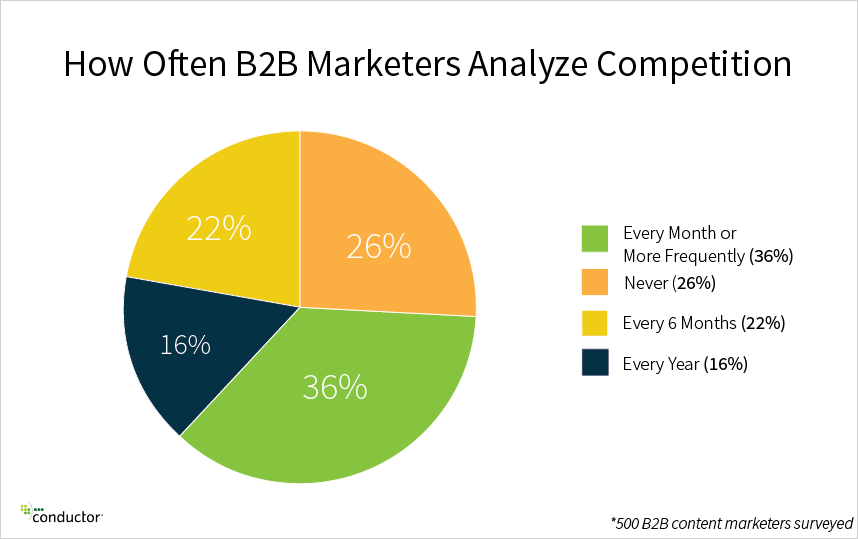

- Three-quarters of companies perform a competitive analysis annually, and a third do it every month.

- A competitive analysis keeps you informed about your market position and helps you better differentiate your brand.

- Your competitor list should include direct, indirect, and distant competitors.

- Automating the data gathering process is key to making the competitive analysis process efficient and manageable.

- It’s critical to report on your findings in order to drive further action steps and keep stakeholders informed.

What is a competitive analysis?

A competitive analysis is the process of researching competitors to understand how your brand stacks up against them on the market. It’s a strategy companies use to learn their market position, differentiate their brand, and improve their value proposition.

Today, it’s an even more powerful strategy than ever thanks to the ease of finding information on the internet. In fact, research shows that 74% of companies are conducting a competitive analysis at least once per year (and more than a third are doing it every month).

Image Source: Conductor

This tells us two important things: first, your competitors are more than likely researching what you do and tracking your performance. Second, if you’re not doing the same to them, you’re probably falling behind.

A competitive analysis is indeed a competitive imperative if you want to control your positioning and get customers to choose you over other brands.

Let’s take a look at some of the specific benefits to performing a regular competitive analysis for your company.

Benefits of performing a competitive analysis

Know your market position

A competitive analysis will help you understand how you compare to your competitors on the market. You’ll get a grasp on our strengths and weaknesses and those of your competitors, allowing you to create more informed strategies, improve where needed, and capitalize on the areas where you’re ahead of the crowd.

Monitor the competitive landscape

Your competitive landscape is constantly changing. Direct competitors may pivot their approach, new market entrants come onto the scene, consumer behavior and preferences evolve, and new technologies emerge (there are just a few examples). The competitive landscape you found in an analysis performed even one year ago is likely not accurate.

When you perform regular competitive analyses, you can monitor the competitive landscape to stay informed in an ongoing way.

Track market trends

Performing a competitive analysis gives you a wider perspective on market trends and events that impact you and your competitors. When you know what’s happening in your industry, you’re better able to prepare for unavoidable challenges, identify and pursue opportunities, and understand how external factors are affecting your (and your competitors’) performance.

Identify new opportunities

New opportunities arise all the time for companies, but you might not know about them if you’re not doing the right research. A competitive analysis will help you spot gaps between you and your competitors — some where you’re at an advantage, and others where your competitors have the upper hand.

Either way, identifying these competitive gaps creates opportunities. You can either improve in areas where you need to catch up with the competition, or double down in places where you’re ahead.

Research new competitors

Startups and other new market entrants (like established companies expanding into your market) can disrupt the status quo you may have been comfortably operating under. When you perform regular competitive analyses, you can be confident you’ll never be surprised by these new competitors and you can adjust your strategy as needed in real time.

Differentiate your brand

Last but definitely not least, performing a competitive analysis helps you optimize your differentiation strategy. You can’t make your value proposition stand out from your competitors’ if you don’t know what theirs look like in the first place. Competitive research helps you create unique offerings and market them in ways that set them apart from your competitors in the minds of consumers.

How to Perform a Competitive Analysis

Now that we know why a competitive analysis is so important, it’s time to walk through the best practices for actually performing one. I recommend the following 7 steps:

Define your purpose

Why are you performing your competitive analysis? What are your goals? The answer to those questions may change over time. Sure, the larger purpose will stay constant — you’re trying to learn about your competitors and how you compare. But you might also have specific goals that differ depending on the time of year and your current business objectives.

Some examples include:

- Launching a new product

- Creating a new marketing campaign

- Expanding into a new market

- Gaining market share over a particular competitor

- Reaching new target audiences

Understanding the goals behind your competitive analysis will determine the types of data you gather and insights you pursue later in the process.

Assess your own company

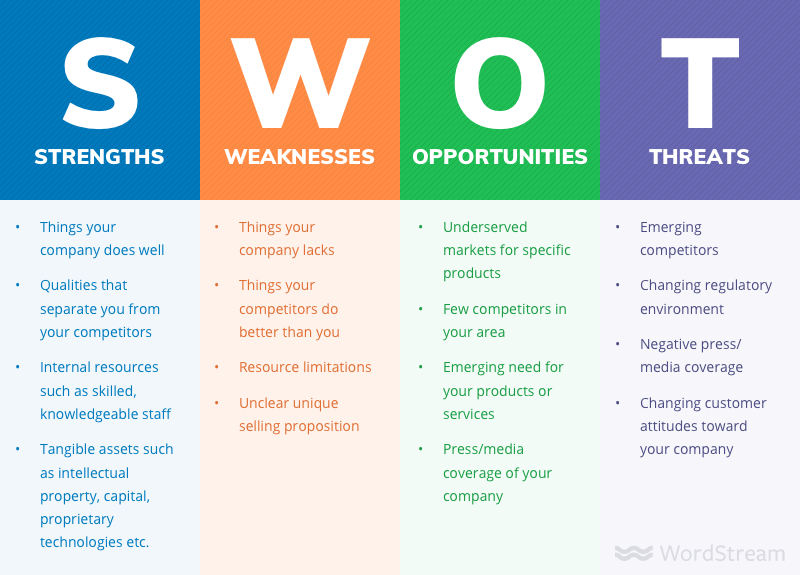

It’s a good idea to start with your own company by performing a SWOT analysis to understand your own internal strengths and weaknesses as well as external opportunities and threats.

Image Source: Wordstream

A SWOT analysis serves as a helpful starting point to guide the direction of your competitive analysis research.

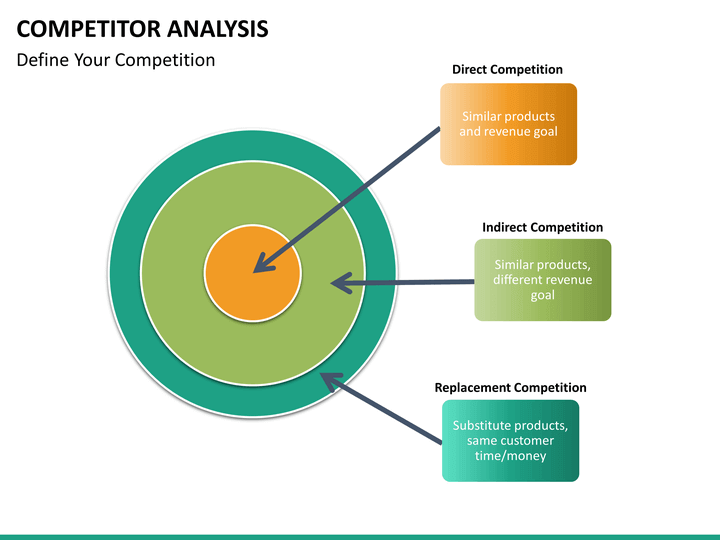

List competitors

Now it’s time to list your competitors. But what defines a relevant competitor in this situation? There are certain brands you compete with directly that will always be top of mind, but you should also consider including other relevant organizations like indirect competitors, leaders in adjacent markets, and new startups emerging onto the scene.

Image Source: The Gerson Companies

Consumers don’t define their decisions by comparing direct competitors only, so neither should you. Know every option your target customer may consider to fulfill their needs, and include them in your competitor list.

Gather as much data as possible

There is a lot of data available to you for your competitor analysis. So where do you start to collect it? The key here is to automate as much as you can to bring the data to you.

Here are some ways to eliminate much of manual work involved in gathering data:

- Create Google alerts for important competitors and topics

- Sign up to receive newsletters and other content from competitors

- Make a list of important industry conferences and other events

- Block out regularly scheduled time to read industry news and competitor websites

When you take measures to automate your data gathering, you can gather it at a higher volume and have it readily available to you at any time you decide to conduct a competitive analysis.

Analyze what’s important

You won’t be able to analyze every single piece of data for every competitor analysis. Once you’ve done a comprehensive data gathering, go back to the goals you set at the start. Prioritize the data and information most relevant to those goals.

For example, if the goal of your competitive analysis is to successfully launch a go-to-market strategy for a new product, you want to focus on competitor offerings that compete against that specific product (rather than comparing companies as a whole).

Report on your findings

Who are the stakeholders in your competitive analysis? Your list might include employees, executive leaders, investors, board members — it depends on your company and your situation. The important thing is to put your findings into a formal presentation and present them.

You should always do this, even if no one asks for it. Here’s why:

First, it helps you organize your findings and pull out the most important insights. This informs your action plan and strategy going forward. Second, everyone in your organization can benefit from understanding your competitive position. Sharing your findings gets everyone on the same page. Third, it serves as a launching point for discussion and can motivate action at every level.

Your presentation doesn’t have to be a daunting project. Create a well-developed slide deck that highlights the most important information, uses visuals to make data points digestible, and points people toward additional resources if they want to dive deeper into your findings.

Create a long-term plan

Finally, figure out how you’ll build the competitive analysis process into your ongoing business strategy. Remember, your competitors are already doing it, and you should too if you want to be equally informed.

Some simple steps to take: prioritize automated data collection, decide on a regular frequency for conducting competitive analyses, and set hard deadlines for reporting results.

Over to You

As you’ll quickly discover during the competitive analysis process, content is one of the biggest establishers of brand presence and authority in every industry. But it also takes a lot of time — time you might not have if you’re running a business.

The team of writers and SEO experts at Marketing Insider Group can deliver you optimized, ready-to-publish content every single week for one year (or more).

Learn more about our SEO Blog Writing Service or set up a quick consultation with me to get started.

The post The Ultimate Guide to Competitive Analysis appeared first on Marketing Insider Group.

Did you miss our previous article…

https://www.sydneysocialmediaservices.com/?p=955